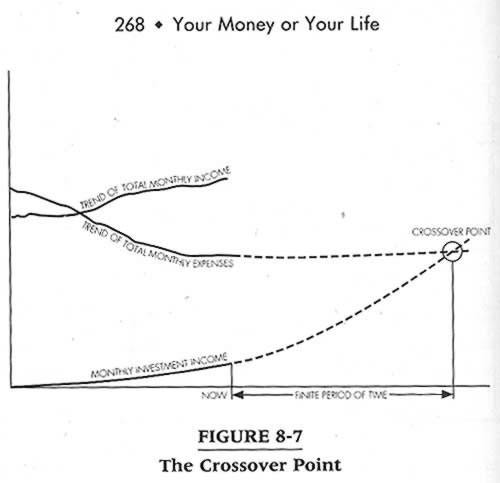

In one of my favorite books titled, “Your Money or Your Life“, I learned about the “Crossover Point.”

Joe Dominquez defined the “crossover point” as:

The point in time in which your monthly income from investments surpasses your monthly expenses.

The crossover point is life changing, because you can now choose to use your time as you wish. Your investment income can be used to cover your living expenses eliminating your need for income from your own labor. This doesn’t necessarily mean you won’t work. It just means you don’t have to work and this provides mental peace.

There is another potential crossover point. I think of this second crossover point as the “Compounding Crossover Point” and define it as:

The point in time in which your investment income surpasses the purchase price of new income producing assets.

This compounding crossover point isn’t as life altering as the first one, but it’s still magical. Your investment income can be used to acquire new income producing assets without any money flowing from your pocket.

A while back I was working with a younger client who was very disciplined financially. He was in his 30s and had saved enough money to buy two single-family homes for cash. After he acquired the first home, he did the math to see how long it would take to acquire the third home. This third home was going to be purchased with the accumulated income from his first two properties.

Estimated purchase price of the third rental property $60,000

Monthly net income from two rental properties $1,400

Number of months needed to buy 3rd home for cash 45

It took him around 15 years to save enough money to buy his first two rental homes for cash. It would only take him 4 years to buy his third home for cash. For his first two homes, he had to save a significant portion of his paychecks. For his third home, he wouldn’t have to save a penny from his paychecks. The income collected from his first two homes would be used to purchase the third home. His investment income would increase significantly at this point as he would now be collecting another $8,400 a year ($700 net income per month) from the third property.

If he followed this plan further, his fourth home would only take 29 months (2.5 years) to acquire. And believe it or not, the fifth home would be purchased for cash in just 21 months (a little under 2 years). Once he had 7 homes, he would be able to buy one new home each and every year for cash.

First two homes – 15 years

Third home – 4 years

Fourth home – 2.5 years

Fifth home – 1.75 years

Sixth home – 1.25 years

Seventh home – 1 year

This is obviously a long-term plan. All combined, it would’ve take him around 25 years to reach the point in time where his investment income would be at the level where he could purchase one home each and every year for cash. He would only have to save funds out of his paychecks for the first 15 years. After this point in time, the plan is self-funding and would grow dramatically with each passing year.

He could obviously expedite this plan by continuing to add his savings to the mix throughout the process so he could afford to purchase homes 4, 5, and 6 faster. Sadly, he decided to put the plan on hold after the first home because he was concerned about the stability of his job. He didn’t want to deplete his cash savings on home number two.

As you might imagine, there is one more crossover point. Unfortunately, I haven’t come up with a cool name for it.

It’s the point in time when….

Your investment income surpasses your living expenses AND allows you to buy new income producing assets on a consistent basis.

This is the best and most important crossover point because you have time freedom and your investment income continues to increase with each passing year.