As you probably know from other posts, I have a daughter headed to college next year. I’ve written about our plan to use real estate to pay for college previously. You track a few of these posts down here and here.

I’ve been studying the cost of college, the student loan crises, and different strategies to reduce the cost of college over the last few months. The cost of college has quadrupled since I graduated and student loans really becoming a major problem for graduates.

One of the main reasons why the cost of college has escalated is because the state funding towards higher education has been dramatically reduced. Consider this from Doug Webber:

“Consider Pennsylvania’s four public research institutions,2 one of which is Temple.3 Average tuition revenue per student (adjusted for inflation) increased by $5,880 between the 2000-01 and 2013-14 academic years (the most recent available data). State appropriations per student have declined nearly $4,000 over the same period, from about $7,750 to $3,900. Put another way, if Pennsylvania restored funding for higher education to its 2000 levels, Pennsylvania’s public research institutions could reduce tuition by nearly $4,000 per year without altering their budgets. For students, the impact could be even greater once loan fees and interest were taken into account.”

Unfortunately this trend isn’t going to change. If you have a child, you really do need to think through the best ways to pay for college and the earlier you get to work on this the better your outcome will be. Most state colleges cost $20,000 a year and most private colleges cost $50,000 a year. Multiply these costs by four or five years and you’ll get an idea of what’s headed your way.

All of this has led me to track down every book I can get my hands on that highlight different ways to reduce the cost of college. My biggest concern is to eliminate, or dramatically reduce, my daughter’s student loans. I hold the opinion that it’s our job as parents to make sure our children don’t end up struggling with student loans after graduation.

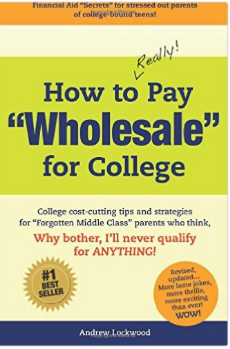

One of the books I got a lot of value out of is titled, “How to Really Pay Wholesale for College: College Cost-Cutting Tips and Strategies” by Andrew Lockwood. It’s my favorite kind of book – self published by an actual expert. I’ve learned more from these inexpensive books than you could image. Books like this one have gold nuggets hidden inside.

One of the books I got a lot of value out of is titled, “How to Really Pay Wholesale for College: College Cost-Cutting Tips and Strategies” by Andrew Lockwood. It’s my favorite kind of book – self published by an actual expert. I’ve learned more from these inexpensive books than you could image. Books like this one have gold nuggets hidden inside.

I ended up reading the book in one sitting and walked away with several ideas we could use to help bring down our out of pocket cost. I learned more from Andrew’s book than I did sitting through several financial aid meetings at my daughter’s high school. One of the most important takeaways is to start thinking about this early. There are a few great strategies in Andrew’s book that I can’t use because we are so close to her applying for college.

After finishing the book, I ended up reaching out to him with a few questions I had about our personal situation. I also mentioned I was going to write about his book. Long story short, Andrew offered his book for free and you can get it here: http://tuitionsecretsbook.com/

You will have to opt-in to get it.

Warning: There is a lot more to consider about college than you might expect. Andrew really illustrates some important considerations engineered to save you tens of thousands of dollars. When it comes to sending your child to college, ignorance is definitely not bliss. Read his book.

If you send a newsletter to your database, you might consider recommending this book. You may be able to help them save a great deal of money on college, too!