The Ultimate Lifestyle Business

Special 48-Hour Discounted Enrollment Price

You’re reading this because you previously requested information on my Ultimate Lifestyle Business where you can create $10,000 to $20,000 a month of cashflow working just a few hours each day and….

….you didn’t enroll in the four week coaching program! (Frowny Face)

Had you enrolled when you originally learned about the program, you would probably have $500 to $1,000 of EXTRA monthly income today. This is because you would have acquired one, or more, manufactured homes over the last few months as we worked together to set this business up for you. I’m not very good with math, but I think $1,000 of extra monthly income is $12,000 of annual income.

By not enrolling, you may have lost $12,000 of EXTRA income in 2017.

Today, you have an opportunity to get this money back by enrolling now with a significant discount!

Before we get to the discount, I wanted to share a few lessons I learned about investing over the years. In 2005, I wrote a book titled: “Income for Life: How You Can Achieve Financial Freedom With This Proven Real Estate System.”

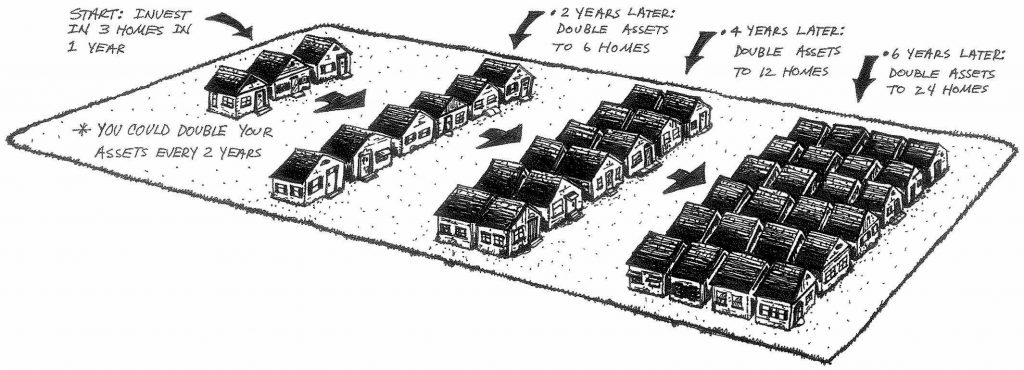

The system I had created and detailed in the book was designed to double your wealth every two years as pictured in this sketch:

The main goal of this plan was to buy three single-family homes and sell them on two-year rent to own programs. When the tenants bought their rent to own home at the end of the two years, the proceeds would be used to buy two additional single-family homes. In essence, we would be compounding single-family homes every few years. One home would buy two homes.

This plan worked very well, until the market crash of 2008.

Several lessons were delivered and these lessons illustrated a few problems with this plan.

- The plan is dependent upon tenants qualifying for mortgages within the two year rent to own programs.

- The plan is dependent upon a rising real estate market.

- The plan is dependent upon lower interest rates.

- The plan is dependent upon the significant use of debt.

When the market crashed, the plan failed due to these dependencies. Home prices dropped and tenants couldn’t buy the homes at the previously agreed prices. In addition, lenders tightened up their loan qualifications reducing the number of people who could qualify for mortgages.

Sitting here a decade later, it’s easy to see the problems in this original plan.

What’s kind of cool is that I can also see one of the most profitable ideas I’ve ever had in the original plan. This idea is:

Homes Buying Homes

One Home Is Turned Into Two Homes

Compounding of Homes.

This is obviously compounding in action and compounding is the single most important investment strategy you can use to your advantage. Any investment approach without the use of compounding will not provide the best long-term results.

Since the original plan included compounding, I didn’t want to abandon it all together. I wanted to keep compounding homes, but I wanted a new system designed to eliminate the problems and challenges of the original strategy.

So, I updated and improve the original plan to:

In this new plan, you can see the same compounding idea at work. Instead of buying single-family homes and selling them on rent to own programs, we’re buying a certain number manufactured homes over a set time frame. This new and improved plan is to acquire one manufactured home each month. Over time, the monthly cashflow increases significantly allowing you to acquire additional manufactured homes.

Manufactured homes buying manufactured homes.

This new plan is NOT dependent upon:

- A tenant qualifying for a mortgage. The tenants in the manufactured homes do not need to qualify for any loans. They just need to make their monthly payments!

- A rising real estate market. The value or pricing of the real estate market has no impact on this plan. Homes can increase in value, decrease in value, or remain flat, and it still works perfectly.

- An increase in interest rates may actually make this plan more valuable as you’ll be able increase your cashflow accordingly.

- These manufactured homes are typically acquired for cash with zero debt.

What’s funny is this new and improved plan creates extreme compounding without the problems in my first homes buying homes plan and most people simply ignore it. In fact, you are in the group of most people, as you ignored this new plan, too.

Now, if you look a little deeper and compare the original plan with the improved plan, you’ll probably see…

The first plan focused on compounding paper wealth.

The second plan focuses on compounding monthly cashflow.

“A man’s wealth is not in the purse he carries. A fat purse empties if there be no golden stream to refill it. Arkad has an income that constantly keeps his purse full, not matter how liberally he spends.” The Richest Man in Bablyon

If you were to follow the original plan and everything worked perfectly, you would have 24 single-family homes in 6 years. You would have 24 mortgages with a significant level of personal debt. Plus, you wouldn’t have a great deal of equity in any of the 24 homes. This is because they would have all been purchased within the last few years. The cashflow from the properties would be consumed by mortgages, taxes, insurance, repairs, maintenance, and city rental inspections.

Compare this to the new plan of buying one manufactured home each month for 12 months, where you would have $3,000 of monthly cashflow and $36,000 a year of extra annual income without owing a penny. The tenants living in the mobile homes would handle taxes, repairs, and maintenance decreasing your expenses significantly. You could use this income in the 2nd year to buy additional manufactured homes compounding your cashflow further. The best part is this plan would continue working perfectly regardless of what happens in the various markets.

- Interest rates increase? So what!

- The real estate market slows down and home prices go soft? Who cares!

- Lenders tighten their mortgage qualification standards? Forgetaboutit!

- The stock market crashes? Awesome, maybe we’ll invest our cashflow in great stocks at bargain prices!

Why am I sharing all of this?

Well, I’m trying to convince you to give this new plan a try. We’re living in interesting economic times right now. Many economic experts are suggesting a large market crash in bonds, stocks, and real estate in the next year, or two. I have no idea if they’re correct, but it certainly seems possible considering the various bubbles we have right now. Wouldn’t it be a good idea to prepare for this possibility?

I’m not suggesting going all in and buying 20 manfuactured homes next month. Maybe, just buy one or two and see how it goes. Start collecting some monthly cashflow and let your actual results dictate what you do going forward. I will help you every step of the way and will make sure you don’t lose money on your homes.

To give you some extra incentive, I’ve setup a special 48 hour sale where you can enroll in my “Ultimate Lifestyle Business System” for just $497. This is a 50% discount off of the regular enrollment fee. You can enroll here.

You’ll receive the following business systems:

Week One: How to Find the Best Manufactured Homes & Test Your Market BEFORE Investing a Penny.

Week Two: How to Sell Your Homes to Qualified Buyers Using My “Auto-Showing” System.

Week Three: How to Manage Your Lifestyle Business Working Just a Few Hours Each Day.

Week Four: How to Setup a Profitable Side Business Making $12,000 to $16,000 a Month Helping Other Investors Do Manufactured Home Deals.

All of this includes my personal help. We’ll setup one-on-one calls where I can answer your questions and help you get started. We’ll work together until you have your first manufactured home deal complete and you’re collecting monthly cashflow. I’ll even guarantee your success!

IF YOU DON’T MAKE $5,000 ON YOUR FIRST MANUFACTURED HOME DEAL, I’LL REFUND YOUR ENROLLMENT PRICE IN FULL.

Remember, this special 50% discount is only available for the next 48 hours.