Last year, I stumbled across an article on Fool.com with this headline:

“Buffett to Berkshire Shareholders:

Be Prepared to Lose Half Your Money”

The headline is really just a marketing hook to get readership. The key sentence in the article is actually this: “Buffett warns Berkshire investors that losses of 50% or more are not only possible, but inevitable in the future.”

We all know that Buffett is correct, right? Many of us have experienced this ourselves, especially in the 2008-2009 crash.

So here’s my question… Should we just accept this and deal with it, or should we take action to prevent it from happening?

This is basically my entire battle against investing mainly for appreciation. This is also why I constantly bang my drum about making your investment priority CASHFLOW.

Whenever the stock market crashes again, I will NOT lose half my money. I will actually be able to use my monthly cashflow to buy stocks and other income-producing assets at discounted prices.

I will never put myself in the position to lose half my money again. You shouldn’t either. Been there, done that. I’ve learned my lesson and have become a slightly better investor in the process. Part of this lesson was reining in my greed.

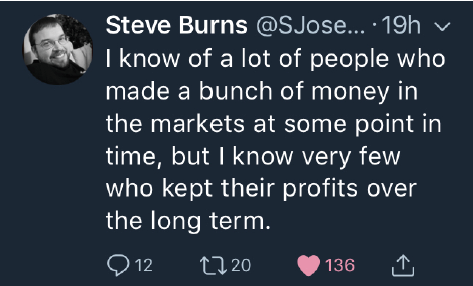

I follow Steve Burns on Twitter. He’s a stock trader and shares different ideas on investing. He tweeted this:

So true. This actually begs the following question:

How do we make a bunch of money

AND keep it over the long term?

You already know my answer.

It’s my 3-Step Cashflownaire Plan, as outlined in my book. This isn’t rocket science. Take your chips off the table and pay off your debt.

It’s hard to lose half your money when you invest 50% of your income into debt reduction.

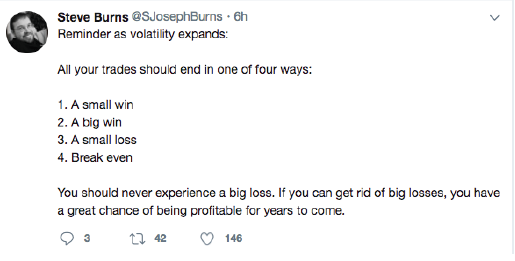

Here’s another tweet from Burns:

In Ed Thorp’s book “A Man For All Markets, From Las Vegas to Wall Street, How I Beat The Dealer and the Market,” you’ll learn about proper risk management.

Everyone talks a lot about how to make more money, very few talk about how not to lose money. Thorp does.

In fact, this is actually one of my biggest regrets. I didn’t do enough to help protect my clients from the 2008 market crash. The reason why is I had never experienced a major real estate crash.

I have been working very hard to right this wrong, over the last two years, in my Cashflownaire Membership, which you can join here for just $1.00.

In Thorp’s book he talks about how he learned to profit from blackjack by counting cards. His plan was fairly simple:

Bet more when the odds are in your favor.

Bet less (or don’t bet at all) when the odds are NOT in your favor.

The more you think about this simplistic approach, the more you’ll realize it carries an important lesson for us to adhere to with our investments.

How do you know when the odds are in your favor?

I’ve thought a great deal about this, and here’s what I come up with:

- When you have control over the investment. You can

use your knowledge, experience and skill set to improve

the asset to increase its income or value. - When you know the outcome of your investment in

advance. Refer to my Cashflownaire Plan book for how to

do this by testing the market BEFORE you invest. - When the investment offers attractive cashflow,

allowing you to get your investment back quickly. - When you can buy an asset significantly below value.

- When you can hedge against financial loss. (See the August 2019 Cashflownaire Issue for one way to hedge your investments).

- When the investment is attractive on a cash basis. For

this I mean you’d be happy with your return on

investment without having to apply leverage. If you need

leverage to generate an attractive return, the odds are

definitely NOT in your favor. - When you’re investing “house” money. When you’re reinvesting your cashflow. This would be our third step in our Cashflownaire Plan. An example would be using your cashflow to buy toll position

businesses. This is obviously after you’ve paid off all your debt.

When Ed Thorp was counting cards at the blackjack table, he would calculate the odds of what each face-card would be when dealt. If his calculations showed the odds were not in his favor, he would make small bets. He would simply keep playing until the odds were in his favor, at which point, he would bet larger amounts of money.

Using this simple approach, he protected against large losses. In fact, he set himself up to have one of Steve Burns four outcomes.

He never would bet in such a manner that would potentially generate a large loss. He always managed risk. This management saved him from losing half his money, as most people will end up doing.

The real problem is we’ve never really been taught proper risk management. We only learn proper risk management after we blow up. 🙁

Think about the average person who is working their ass off trying to save for retirement. They will definitely lose 50% of their money at some point in the future whenever the market crashes, just as Buffett warned.

This is because they are investing the majority of their money when the odds are NOT in their favor. They have no control. They’re investing for appreciation. They’re not investing house money. Their investments are all leveraged, and they haven’t hedged against loss.

Take a minute and think about each of your investments. Are the odds of success in your favor? If not, what can you do to protect yourself?

Now, I realize proper risk management isn’t sexy.

However, it’s extremely important and it’s certainly something you should think about so you can be one of the few who are able to keep their profits over the long-term.