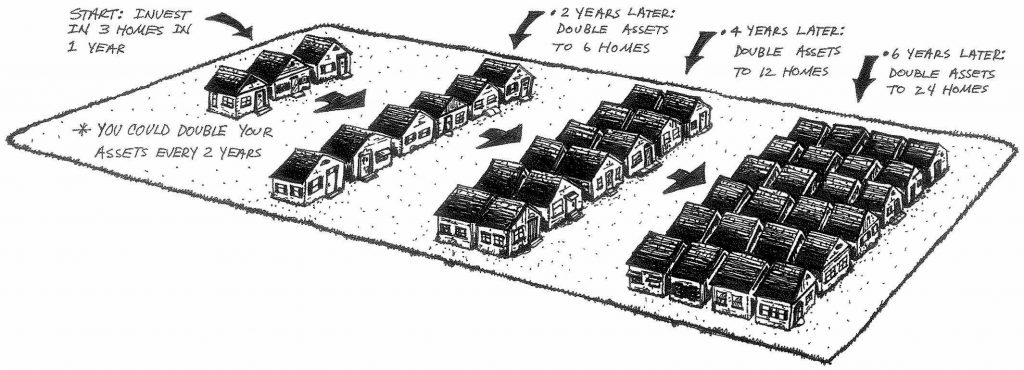

Below I’ve included a sketch (by Joe Mercadante) of my real estate investment plan from before the 2008 real estate market crash.

The plan was to buy three single-family homes and offer each home on a two-year rent-to-own program. When the tenant bought out the home, the proceeds were to be used as a down payment on two new single-family homes. This would allow us to turn one home into two homes, unlocking the magic of compounding, except we’d be compounding homes!

These homes were all purchased outside of tax-protected accounts. We’d usually buy these homes with financing, which meant that the gain on sale was subject to capital gains tax. To defer this tax gain, we would use a 1031 tax-free exchange, rolling the tax gains into the new properties.

This is still a fantastic plan in an appreciating real estate market.

Unfortunately, the plan doesn’t work in a declining real estate market. Once the market declines, you have to switch back over to offering your homes as straight rentals until the market eventually rebounds.

Well, what would happen if you were to use this basic plan on homes you purchased inside of your retirement account?

You wouldn’t have to worry about doing any 1031 tax-free exchanges. This is because you wouldn’t have to pay any capital gain tax at the time your property sells. If you did this in a Traditional Self-Directed IRA, you’d defer your gain and if you were able to do this in a Roth Self-Directed IRA, your gain might actually be tax-free.

If this idea appeals to you but you don’t have enough saved in your IRA to buy a home for cash, you may be able to use a “non-recourse” loan.

A non-recourse loan is a loan that has no recourse against the borrower, which would be your self-directed retirement account. The only recourse the lender would have is the actual property itself.

This “non-recourse” financing may open up the opportunity for some people to use this strategy without having enough saved to buy homes for cash.

NOTE: If you borrow funds with “non-recourse” financing, your retirement account would be subject to UBIT (Unearned Business Income Tax.)

This may open the doors for you to implement my homes buying home plan inside your retirement account!

But wait there’s more…

If you’re 59.5 years old and have money in your employer’s 401k plan, you may be able to use an “In-Service Distribution” to roll these funds into a Self-Directed IRA where you can buy real estate. The best part about this is that you don’t have to leave your job to use this special provision to move your money.

Many (around 70%) company sponsored retirement plans allow for “in-service distributions.” You’ll have to look into your company’s plan to see if you’d be able to use this strategy.

Self-directed retirement accounts are the single best wealth-building tool because they allow you to invest your retirement savings directly into affordable housing assets offering monthly income.

I actually funded my Self-Directed IRA many years ago when I left my accounting job. I rolled my 401k into my Self-Directed IRA and have used those funds to acquire single-family homes and manufactured homes. I personally haven’t used any “non-recourse” loans to buy real estate in my retirement accounts; however, it might make sense for two reasons:

1. You’d only be borrowing 60% of the value of the home and you’d never be an over-leveraged position.

2. The loan is non-recourse, and the lender wouldn’t be able to go after any other assets.

If you’d like to learn more about how to use a Rent to Own Program, become a Cashflownaire Member at this link and I’ll send you my Complete Rent to Own System. This system is one of the new member bonuses you’ll receive instantly.

This system includes everything you’ll need to get started with Rent to Own Programs including the forms I use with my properties.

P.S. These strategies are obviously advanced, and you should definitely discuss them with your tax professional before taking any action. You also want to be sure you understand and plan for any UBIT that you may incur, if you finance real estate owned inside your retirement account.

P.P.S. My friend, Joe Mercadante, who created the homes buying homes sketch passed away two years ago. RIP Joe. I miss you, brother.