Yesterday I was working out at the gym. 50 Cent is typically on my playlist when weight training. Not sure why, but his music helps me take things to the next level.

I was listening to his song “How to Rob“, which I’ve included for you here:

Warning: If you’re easily offended, please don’t watch the video or listen to this song.

I had to stop the music over this line in the song:

“The only excuse for being broke is being in jail.”

You know what?

He is 100% right.

We could probably add being sick as a valid excuse, too.

We have unlimited opportunities to make money and the only two valid excuses for being broke are being in jail, or being very sick. That’s it.

No other excuse is valid. Any other excuse we use is simply a lie we tell ourselves.

With the internet we can learn just about anything for free. We can study businesses, marketing, and different investment strategies. Or we can go to our local library and get thousands of books for free. If you are not incarcerated and you’re not sick, you have no excuse for being broke. None. Being broke is a choice you’re making for your life.

This may get you fired up. If it does, it’s because you know this is true and you’ve been lying to yourself. We all lie to ourselves about many things and we can only get better when we choose to stop lying to ourselves.

If someone else can be affluent, so you can you. The only thing hold you back is the lie(s) you’re telling yourself.

Please understand I’m not suggesting you need to devote your entire life to making money. I’m certainly not. I’m suggesting there really is no reason to not create the income and wealth that you want.

Okay, let’s shift gears and talk about how to do it…

When the average person goes to work, they have two primary goals:

1. Get money to pay bills.

2. Save for retirement.

Because these are their primary goals for work, they aren’t able to make significant financial progress.

The average person gets paid ONE TIME for their work. They struggle to use this one payment to provide for their current living expenses and to prepare for the future.

When a Cashflownaire goes to work, they have one primary goal:

BUILD, CREATE, OR BUY INCOME PRODUCING ASSETS

These assets provide income for them throughout their lives AND they can continue providing income for their children, grandchildren, and great grandchildren (or charities) when they pass.

The Cashflownaire gets paid multiple times for the same work. These extra payments are then used to buy or create more income producing assets.

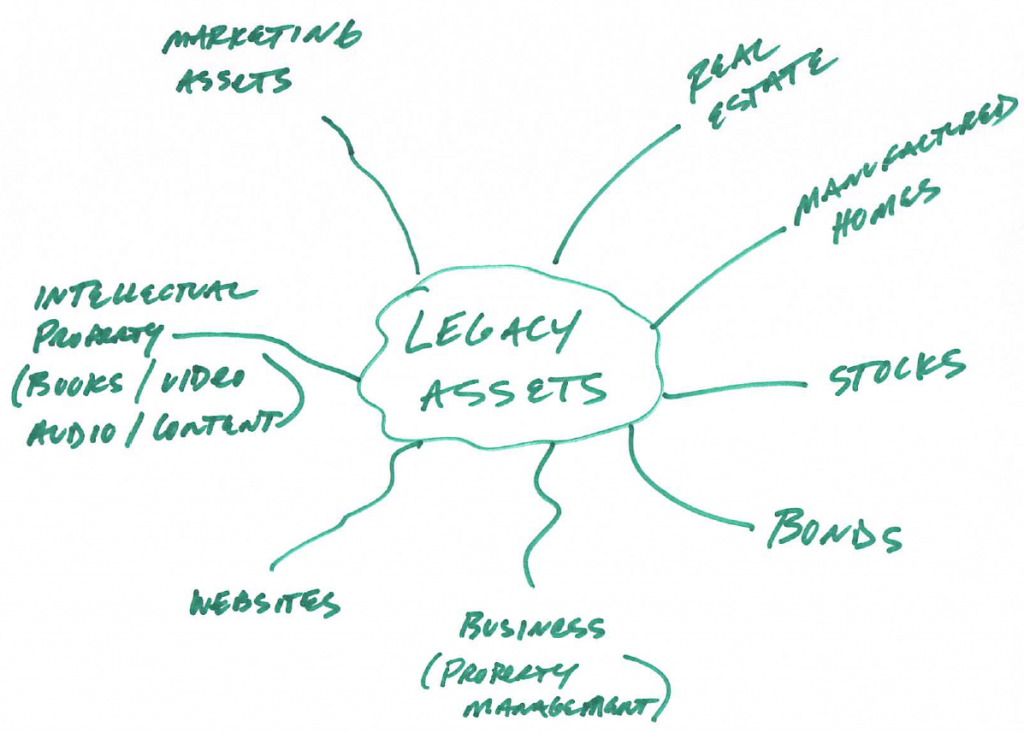

Assets are legacy assets when they provide income without your labor. This income flows to you whether you work or don’t work. Whether you’re at home or traveling. And this income continues to flow whether you’re alive or not. These assets include the typical assets of real estate, dividend stocks, and bonds. However, they also include the following:

1. Cashflow businesses you own.

2. Income producing websites you’ve built.

3. Your intellectual property. This includes content you’ve created: written, video, audio.

4. Valuable marketing. Sales letters that generate income. “The Million Dollar Sales Letter.”

5. Websites you own/control that provide income.

I write a lot about this idea and I do so because it’s important.

Consider this lesson taught to Hetty Green by her father:

“It doesn’t matter what you do in life as long as you leave more to your children than you inherit from me.”

Hetty Green left a $400,000,000 million fortune to her two children. She received a small fortune from her father and used the magic of compound interest to turn it into a massive fortune.

Think about this idea for minute.

If each generation of your family uses Mr. Green’s basic financial plan, your family will get richer and richer with each generation.

It’s kind of cool to think about.

And it isn’t really hard to do with compound interest.

Unfortunately none of this is possible if you don’t think about creating, building, or buying legacy assets. Hetty Green spent her life accumulating legacy assets: real estate, bonds, stocks, and more.

If you’re going to work, why not focus on creating, building, or buying income producing assets?

Why not setup situations where you get paid multiple times for your work instead of one time?

The goal of life is to enjoy it.

The goal of work is to create income producing assets.

And remember, there really is no excuse for being broke.

There is also no excuse for leaving your family less than you’ve received from your parents.