After the Airbnb webinar, I’ve received several emails with different questions. I thought I would address some of these questions for you in this short letter. I’m putting this on a separate page on my site and this page isn’t really available to my general audience. It’s only for you! If you would like to watch the webinar replay, you can find it here.

Let’s first start with one of the emails I received:

————————————————————————————

I watched the replay, thank you. I almost bought the course a couple months ago, but didn’t pull the trigger.

————————————————————————————–

Here’s my reply:

For me, I think we can look at this from one of two perspectives:

1. New business opportunity with limited risk. I’ve been doing this stuff for 25 + years and haven’t found a business this profitable that can be started with a few thousand dollars. We can do this ourselves, or bring on someone to help us and oversee them. Example: I always gave opportunities like this to agents on my team because it gave them leadership opportunities. Plus it made the business more profitable. These profits can be leveraged into a high sales price if you decide to sell the business.

2. As an investment opportunity with incredible ROI. This is really why I’m interested in this. My best real estate investment is a 5 bdrm home I bought in the crash for $85,000. I paid cash for this home. It rents out at $1,495 a month. After paying taxes and insurance, I probably net around $1,000. My annual ROI is 14%. To get this 14% return, I had to invest $85,000. Yes, I could have increased my return by financing the property. My best mobile home investment probably has an annual ROI of 100%. My mobile home investments typically require an investment of $8,000 to $10,000.

I ran the numbers on a few of Brian’s Airbnb listings and…

One of his listing costs in $1,700 a month in rent. He invested $3,600 for the first month’s rent and the security deposit. After paying the monthly rent and utilities, he conservatively nets around $1,200 a month based on the numbers in his Airbnb account. Total initial investment of $3,600 with annual net income of $14,400. This is an annual return of 300% with very limited risk. Even if he had to invest another $2,000 in furnishings to get started, he would still generate an annual ROI of 157%. Plus, Brian will probably get his $1,700 security deposit back at the end of the lease.

I’m not sure anyone is really seeing this???

Brian doesn’t mention this on the webinar and this is because he doesn’t want to make income claims. I don’t blame him. There is no guarantee anyone will make any money with anything, including this! However, if you’re a sophisticated investor and understand risk vs. reward, this ROI potential should make you think seriously about this opportunity. It’s what made me want to pursue this myself.

We can’t find these returns consistently in the stock market, bond market, or the traditional real estate market.

Take this one step further and think about the possible compounding of a 150% ROI. What if we reinvested the $1,200 profit from your Airbnb listing into new income producing assets? Even if you just made extra payments on your mortgage principal balance, you would easily increase your annual ROI and save a significant amount in interest.

Furniture? You’re going to let that hold you back? Why not focus on finding furnished properties? This is what I’m going to do. However, Brian actually shows you how to handle furniture quickly and cheaply in this course.

(My wife enjoys shopping and staging. It might be crazy, but she could actually get paid to shop! LOL – just kidding. Don’t show her this!)

—————————————————————————————————————–

In the webinar, Brian includes a bonus where he’ll show you how to see actual Airbnb demand. For me, this is very helpful.

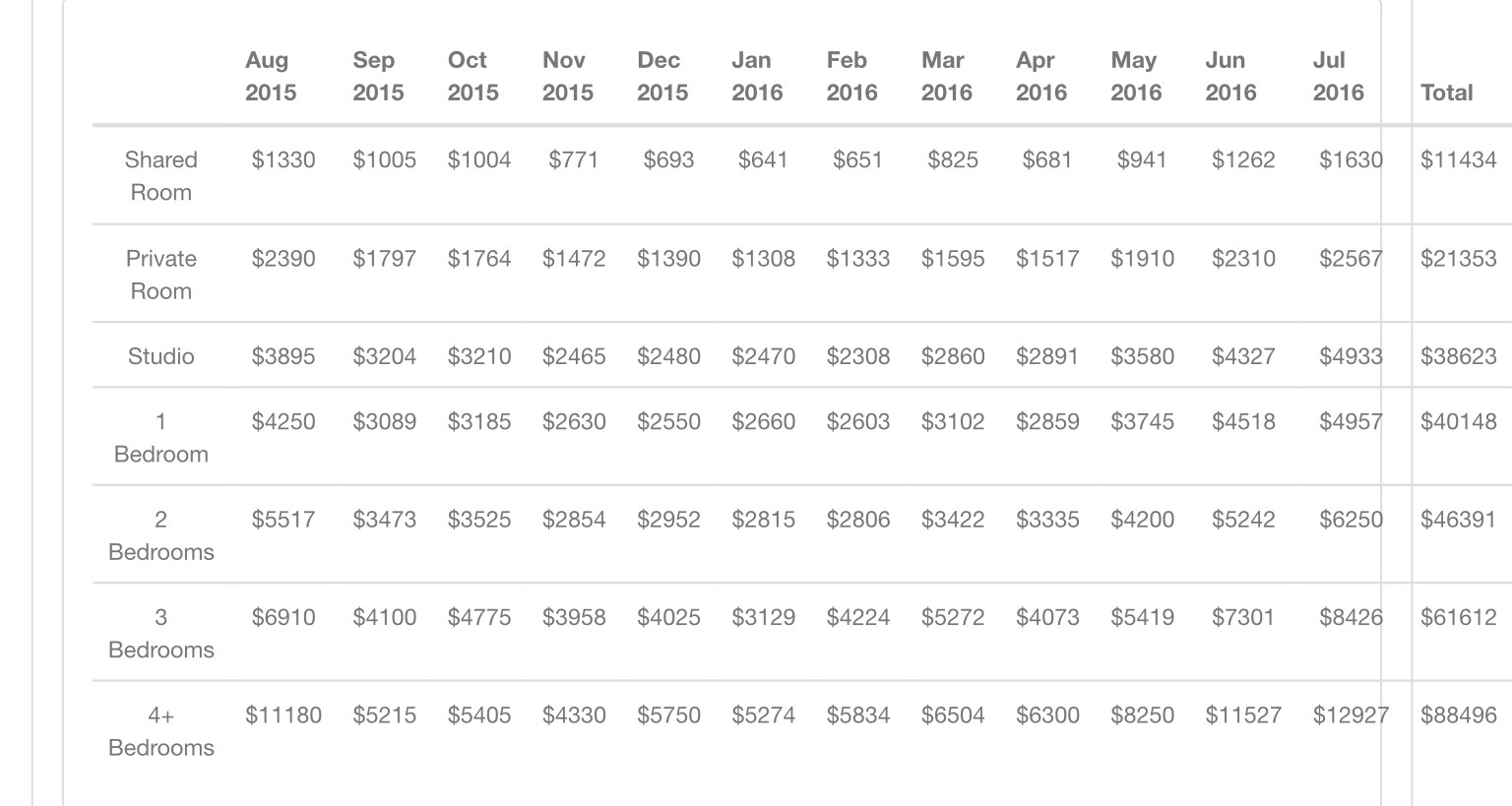

Here’s a screenshot of the average monthly Airbnb income in Cleveland for 12 months:

The last column on the right shows the average annual income for the particular type of property.

By spending a few minutes on Craigslist, I can easily estimate the potential profit available. Here’s a screenshot of furnished two-bedroom, two bath condo in downtown Cleveland:

As you can see, this is a very nice condo with all appliances, garage parking, and it’s fully furnished. The rent is $2,147 a month for a total annual cost of $25,764. By studying the average Airbnb numbers from above, we can see that the average annual income for a two bedroom is $46,391. This particular condo would provide an estimated annual profit of $20,627 before utilities and miscellaneous expenses. Let’s reduce this profit by $5,000 for expenses for a net profit estimate of $15,627.

As you can see, this is a very nice condo with all appliances, garage parking, and it’s fully furnished. The rent is $2,147 a month for a total annual cost of $25,764. By studying the average Airbnb numbers from above, we can see that the average annual income for a two bedroom is $46,391. This particular condo would provide an estimated annual profit of $20,627 before utilities and miscellaneous expenses. Let’s reduce this profit by $5,000 for expenses for a net profit estimate of $15,627.

To rent this condo, we would probably need $4,294 (security deposit and first month’s rent). Our $4,294 investment would provide around $15,000 a year of income. This is a 263% return on investment without borrowing $1.00. At the end of the lease, we would probably get the security deposit back.

Plus, I would have the ability to use this condo, too. I could head downtown for dinner with my wife and stay there. It’s a cool bonus!

Having said all of this, it IS important to understand this investment will require work. We can do this work ourselves, or we can outsource it like Brian teaches.

The best investments are ACTIVE investments. I would love to be a passive investor, but the returns are too low. I’m will not accept 10% annual returns. I AM willing to work for my investments to increase the annual return on investment. This is because of the power of compounding. A higher annual ROI can turn into a massive number through compounding.

If you’re not willing to be an active investor, this Airbnb opportunity isn’t for you.

I hope this helps answer a few of your questions.

For the record, I AM doing this business. I won’t take on my first property until later this summer. We’ve got a few graduations over the next two weeks and then we’re taking a long family trip to Europe. When we return, my wife and I will roll up our sleeves and get started.

If you would like to sign-up for his course on how to build an Airbnb Empire, you can do so here.