This post may be the most important thing I’ve ever written. Really. Please read it and think about it as it pertains to your life. What I share here has taken me 25+ years to understand and I’ve worked hard to try and express this so it makes sense.

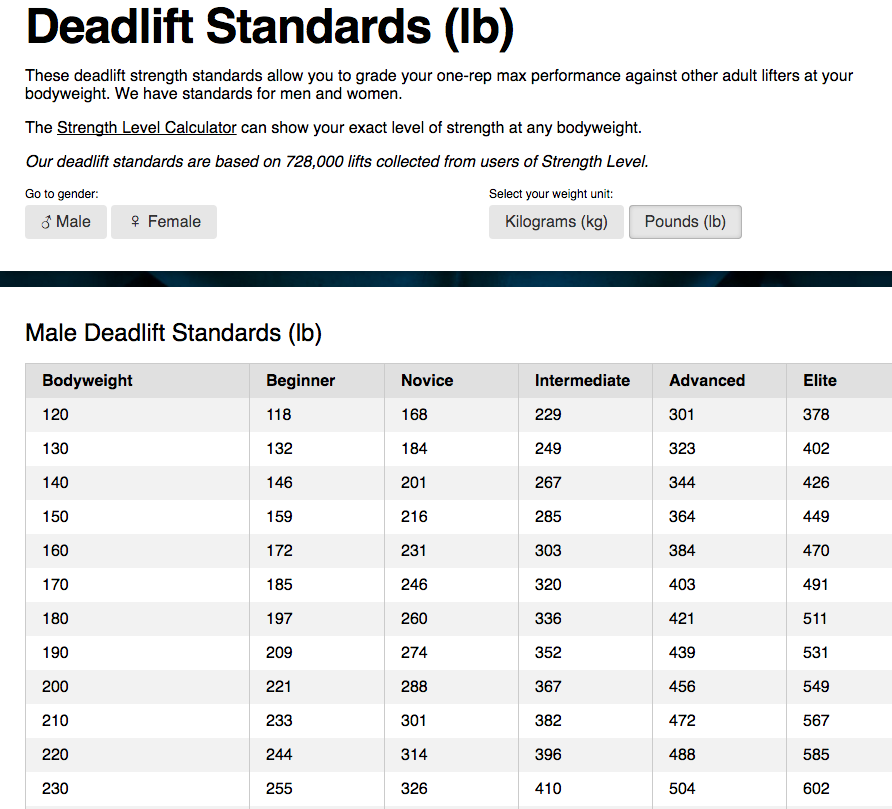

In 2011, a friend recommended I read a new book titled, “Fit: An Unconventional Guide to Using Conventional Methods for Creating Fitness For the Real World.” This was a great book for several reasons. The most important reason was that this was first time I learned about performance standards for strength and fitness. The basic idea is to measure your strength and fitness against certain standards to see how you’re progressing. You can look at charts for your age, weight, and gender and see where you stand against the standards. Here’s a screenshot of how this looks:

(Note: This chart was from StrengthLevel.com and it isn’t the same standards found in the book I referenced. This chart has been included so you can get a feel for how these strength standards look. Click on the image to enlarge it.)

You can see the different strength levels based upon body weight. (Unfortunately, this chart doesn’t factor in age, which I think is an important consideration with regards to strength.)

The reason why these standards are important is because they give us something to work towards. If you deadlift, you can set a specific goal for one of these standards. It’s important to understand achieving advanced and elite standards may take years of effort. You don’t just walk into the gym and start deadlifting 500 lbs. You have to build this level of strength over time with small increases compounded over time.

When I first saw these standards, I was horrified. I had been lifting weights for years and didn’t rank very high against these standards. Truth be told, I had never deadlifted, which is one of the most important exercises for strength. I was pissed at myself, because I realized I had wasted years of opportunity in developing my strength. Had I learned about these standards and basic strength programming when I started lifting weights, I would have been a lot stronger.

I decided to start from the beginning and setup a basic strength program which included deadlifts. Over the next year, I increased my strength dramatically as I worked towards higher categories in the strength standards.

Throughout all of this, I started to realize there were standards for retirement savings, but no standards for cashflow. I’m sure you’ve seen the charts prepared by financial planners showing how much you should have saved at certain ages in order to be able to retire at 65. I’m not going to bother including any of these charts and this is because I think they’re worthless. They’re focused on paper wealth, not income. Income pays the bills. Paper wealth doesn’t. Plus, who wants to work until they’re 65? So I sat down and made my own standards for cashflow.

Here they are:

The strength standards I found back in 2011 really helped me, as they gave me direction with my workouts. I had a goal and could work towards that goal with each workout. Working toward the strength standards provided an immediate return on the time invested at the gym.

Workout –> Increase Strength

This return gives you a benefit you can use going forward AND it’s important to understand this return compounds over time.

These monthly cashflow standards were designed to do the exact same thing…. give us direction. These standards provide a goal for us to work towards. Each dollar of monthly cashflow you create will provide a future benefit as it compounds over time.

Take a minute and see where you’re at in this chart. Are you on track based upon your age and current monthly cashflow?

My guess is you aren’t on track. More than likely, you’re way below these standards. The reason why is you weren’t taught to focus on creating cashflow. You were taught to focus on wealth accumulation.

These standards show how good you are at creating monthly cashflow. If you’re below the standards for your age, you’re not doing a great job with asset accumulation. This should be an eye-opener for you. It certainly was for me.

I sketched this chart out myself a few years ago after learning about strength standards. I wasn’t very happy with where I stood, so I set a goal to be at the “elite” cashflow level for my age. I felt like I had been wasting my time, just like I did when I studied the strength standards. I didn’t have much cashflow to show for all the work I had done in my life. So I created a plan to increase my cashflow, which I’ve shared previously, and followed this plan religiously. It became my primary focus and provided a great deal of direction.

The cashflow standards began providing a return on the time I invested working. Just like the strength standards provided a return on my time at the gym. When we work, we are trading our lives away for money. We should demand a very high return on this investment because our time is so incredibly valuable. The high return we should focus on is monthly cashflow and this is because cashflow provides everything we want in life.

I realize this is all new to you, but as you think about this idea a little more, you’ll probably realize it’s impossible to hit these cashflow standards through the typical financial plan we’ve been taught to follow. You know the drill… get a good job, save 15% of your income and you’ll enjoy bliss in your golden years! I’ll say it again, because it is so important:

It IS impossible to achieve these cashflow standards through a paycheck alone. Just like it’s impossible to deadlift 500 lbs by running on a treadmill.

The only way you’ll make significant progress on these cashflow standards is if you focus a portion of your time on buying, building, or creating income producing assets. You cannot do what everyone else does and expect to achieve financial freedom in your 30s, 40s, or 50s. You’ve got to get off the treadmill and pick up heavy weights. You’ve got to get out there and start accumulating income producing assets. (businesses, real estate, websites, etc.)

There is no other way.

If you haven’t seen my Cashflownaire plan, you can have a PDF of the plan emailed to you. Just enter your email here:

[optin_box style=”9″ alignment=”center” email_field=”inf_field_Email” email_default=”Enter your email address” integration_type=”infusionsoft” double_optin=”Y” list=”589″ name_default=”Enter your first name” name_required=”Y” action_page=”https://m291.infusionsoft.com/app/form/process/01dc0f3daf40ca18d942c7255ad61384″ opm_packages=””][optin_box_hidden][/optin_box_hidden][optin_box_field name=”headline”]Here’s The Headline For The Box[/optin_box_field][optin_box_field name=”paragraph”][/optin_box_field][optin_box_field name=”privacy”]We value your privacy and would never spam you[/optin_box_field][optin_box_field name=”top_color”]undefined[/optin_box_field][optin_box_button type=”0″ button_below=”Y”]Download the PDF![/optin_box_button] [/optin_box]

8 replies to "How Much Monthly Cashflow Should You Have Right Now?"

Hi Rob,

Very eye opening/humbling post. Thanks to your help with my first deal. I’m searching for my second investment. Your cashflownaire biz is my primary plan to join the elite for my age group.

Jeff, the cashflow standards were as humbling for me as the deadlifting standards were! I was way below the elite level for my age. However, by really focusing on cashflow above everything else, I was able to make significant progress. I know from working with you on your first deal, you’re extremely action oriented and you’ll make accelerated progress as well! Looking forward to helping you on the journey! Rob

Hi Robert,

Great post, and really insightful blog overall.

My question-

The catch is the cash flow should be there, without your labor, once you acquire/build the asset. The assets you mention, business, real estate, web properties etc, all require certain sizable effort. Eg.- Rent collection time, tenant grievance solutions etc if you are a landlord and rent your properties. You do end up spending time on maintaining these cash flows, *even after* you have acquired/built them. Is it really passive?

So apart from owning these assets yourself, is there anything else about the passive nature of this cash flow that I am unable to grasp?

Yes, you have to manage the assets providing you with monthly cashflow! Or you can hire someone else to manage the assets on your behalf. I choose to manage my assets. The time required to manage assets is significantly less than the time required to build or acquire the assets. Plus, over time your management skills improve reducing the management time dramatically. As an example, you get better at avoiding problem tenants eliminating many management challenges, which saves you hours of management time. Your skills compound as your cashflow compounds.

This is a very moving, eye-opening article for me. I’m very big into fitness so the analogy couldn’t relate anymore or be more spot on. I’m 36 and have $250 monthly cashflow right now. The Cashflow standards chart is already taped on the wall above my monitor. This is hilarious and sad that I’m at a novice level for a teenager right now on the chart. More hilarious to me tho… I just see the future now how amazing of a story it will be when I’m at the elite level for my age group. Thank you very much for the motivation and putting some numbers in place to conquer. This chart should be in every school across America.

Reid,

I can already tell…. you’ll be moving through the cashflow levels fairly quickly! As you know from the gym, what you measure improves!

Rob

For the charts purpose how would you define cashflow from rents from a typical SFR rental property? If it rents for $1000 per month but has expenses of $500, would you say the “cashflow” is $1000 or $500? Is “cashflow” in your mind a gross or net number? Great article!

John, Great question! The answer is NET cashflow. The amount you can actually spend or reinvest. Rob