When I ask people how many passive income streams their kid(s) have, they usually tell me 0.

This answer is actually incorrect because your kid has at least one passive income steam….you! You go to work each day to generate income for your children. This income is completely passive to them, as it appears magically.

Shouldn’t our kids have real passive income streams?

Several years ago when my oldest daughter was 4 years old, I hired her for my business. I had created a program highlighting how to turn our children into millionaires and used her image in the program. I also used her picture in my monthly newsletters for the business. To compensate her for the use of her image, the business paid her $2,500 for two years. We used this $5,000 of income as the first contribution to her own self-directed IRA. She is 16 now and hasn’t contributed any additional funds into her IRA since this initial contribution.

This initial contribution was used to purchase a mobile home investment property. This mobile home was rented out for $280 a month. Once the mobile home was rented, her IRA account began collecting $280 a month. This process continued for about two years when I realized her account had accumulated a little over $6,000 from the monthly income generated by this mobile home investment. I got to work and found another mobile home investment opportunity, which was purchased with the cash accumulated in her IRA account. This 2nd mobile home rented out for $195 per month.

We’ve continued this process and now her retirement account owns three mobile homes generating $779 each month. In addition, we’ve started using the mobile home income to buy dividend paying blue chip stocks. The total account value today is a little over $25,000.

Her $5,000 total contribution when she was 5 years old has compounded into $25,000 in 11 years. More importantly, this account should grow by an extra $9,240 each year as income flows into the account from the three mobile homes.

This continues to amaze me.

Her IRA now collects significantly more annual income than what she originally contributed. Sure, we’ve had a few challenges with these rentals over the last 10 years. We’ve had a few vacancies and two evictions. We’ve also have had a few repair issues, too. These expenses have been paid by her IRA. Some might hear this plan and think it isn’t worth it. I would argue differently by how the account has grown over the last 11 years.

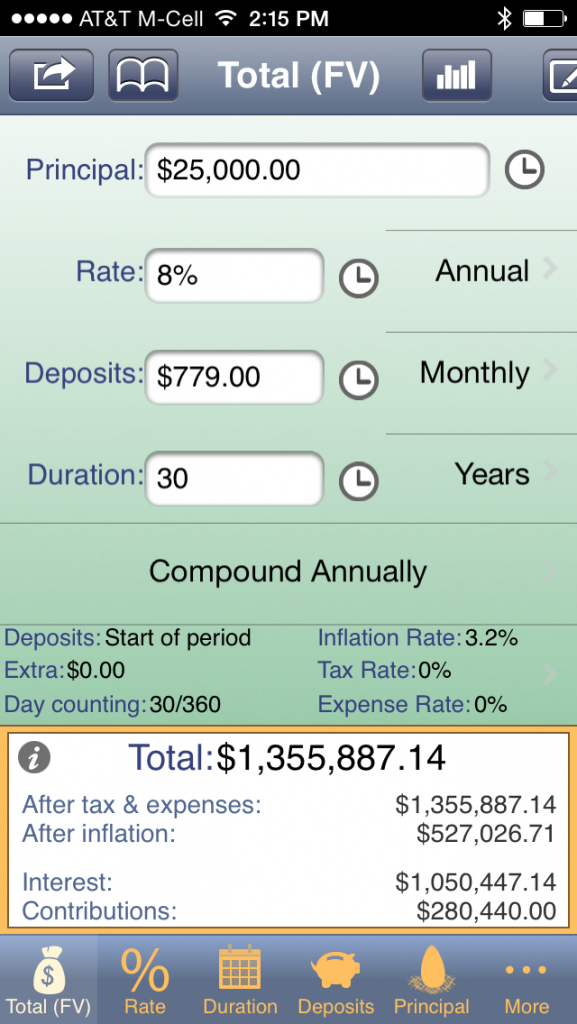

The good news is this compounding process will continue over time. We can let these monthly rent checks pile up for a few months and then use the funds to acquire shares of more blue chip dividend stocks. Or we can look for another investment property. Any future assets purchased would be funded by the income from her investments without another contribution into the account. To get an idea of what might be possible, I’ve crunched some numbers in my favorite iPhone app, Compoundee:

If we she continues this process going forward over the next 30 years, her IRA may grow to $1.3 million when she turns 46 years old WITHOUT any additional contributions. This is assuming she keeps at least 3 mobile homes generating $779 each month and these funds are invested with average annual return of 8%. More than likely, this will mean she’ll need to purchase more mobile homes using funds in her IRA in future years to replace the existing homes, as mobile homes do physically depreciate over time.

Compounding is truly magical, especially when it starts in the early years.

For your children to use the power of compounding to their advantage, they have to have real passive income streams. This income can be reinvested over and over again for decades.

If you stop and think about it, time is the biggest asset our children have to their advantage. It makes a lot of sense to take advantage of this asset by setting up a compounding machine for their benefit.