Leeeanne and her husband owe $108,000 in combined student loan debt. Their monthly student loan payment is $928. They have tried to lower the monthly payment without luck, because their loans are private loans. Their student loan payments are so high they cannot afford to have a baby. They have to put their lives on hold for years until their loans are paid off.

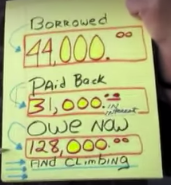

If you continue watching the video, you’ll see a gentlemen who borrowed $44,000 in student loans to get his master’s degree. He has paid back $31,000 in interest and currently owes $128,000.

Today, he owes $84,000 MORE THEN HE BORROWED. His outstanding loan balance increases by $950 a month. He is in his 60s. He is worried that his wages are going to be garnished and if he’ll be able to pay his rent. He said he thought he was majoring in psychology, but he was really majoring in student loan debt. 🙁

Student loans have become a real life nightmare. They’re far worse than high interest rate credit card debt. The reason why is because lenders allow students to defer their loans and/or make student loan payments that are less than the interest owed. Any unpaid interest gets added to their outstanding student loan balance increasing the total amount they owe with each passing year.

If you have children, this may be their future unless you don’t something about it right now. I’m not kidding. This is a major crisis and our children can easily get sucked into a similar situation. Most parents do not plan properly and their children end up paying the consequences.

I’ve spent the last two months writing a book on how to use real estate to pay for your child’s college education. I’ve read countless books and reviewed dozens of real life student loan horror stories. During this time, I also have gone through the college financial aid process with my oldest daughter.

It certainly has been an education and I’ve learned a great deal. I feel like I’ve gone to college to learn how to pay for college!

Here’s the bottom line:

The cost of college has skyrocketed and most new college students are completely unprepared financially setting them up for tens of thousands of dollars in student loans. These student loans have a significant negative impact on their lives for years after their college graduation.

I happen to hold the unfavorable opinion that, in most cases, large student loan balances are due to our lack of planning as parents. If we prepare properly, our children may be able to side-step years student loan payments. If we don’t prepare properly, our children will be at a major disadvantage in life as they’ll be stuck paying thousands of dollars a year making monthly student loan payments.

We can sit and argue all day about whether or not a college degree is necessary and we’ll never come to an accurate answer. We really have no clue what the future holds for our children. We don’t know what opportunities they’ll have with, or without, a degree.

My thinking is…

A college degree isn’t going to hurt our children IF they can graduate without having to make large monthly student loan payments out of their paychecks.

This is obviously a BIG “IF.”

If our children end up having to make large monthly student loan payments out of their paychecks after college, they’re going to suffer in all areas of their lives. They won’t be able to save for retirement. They may not be able to buy a home. They may not be able to afford children. They may have to get multiple low paying jobs.

It doesn’t have to be this way.

You can help your children go to college without having to make student loan payments upon their graduation. Check out my new book on Amazon here.

3 replies to "The Student Loan Crisis – (MUST READ IF YOU HAVE CHILDREN)"

This is very insightful. Thanks for sharing.

Student loans we’re the reason I started looking into real estate and other options to increase my income. I graduated with $82k in debt in a career that would pay $30k-$40k a year. Did the math and realized with a $30-40k a year job, minus even basic living expenses I would pretty much be paying student loans for the rest of my life.

Luckily I’ve discovered the world of marketing, business, and investing and am chipping away at my debt every year. Looking to purchase rentals in the upcoming years too for cashflow to finally escape this stupid mistake I made and teach my future kids not to make the same mistake.

Love your blog by the way and glad you are putting this type of information together for people.

Tony, I honestly can’t believe how bad student loans can be. We really need some major changes to fix the problem, but these changes will never come. The lenders are making too much money. Sounds like you’ve got a game plan to conquer your loans! Appreciate your comment! Rob