The Urban Institute and the Housing Finance Policy Center, think tank-type non-profit that focus on housing policy issues, released a lengthy report two years ago. The report is titled, “Headship and Homeownership” and it looks at, in-depth, household formation and homeownership. Even though it’s a little dated, the findings are still 100% relevant.

One of the conclusions of this report is that the homeownership rate will continue to decline over the years in large part because the new households being formed are not in demographics typically associated with high ownership rates. Here is the complete list of the report’s conclusions:

1. Household growth can be expected to be reasonably robust between 2010 and 2020 as the millennials form households. This growth will taper off between 2020 and 2030 as attrition of older households grows.

2. Between 2010 and 2030 the overwhelming majority of household growth will be nonwhite: 77 percent between 2010 and 2020, and 88 percent between 2020 and 2030.

3. The number of households headed by someone age 65 or older will expand dramatically: by over 9 million house holds in this decade and 10.5 million in the 2020s.

4. The absolute number of homeowners will grow, owing to net new household formation, but the absolute number of renters will grow much faster. New renter households will outnumber new owner households in this decade and in the 2020s.

5. The homeownership rate will decline from 65.1 percent in 2010 to 61.3 percent in 2030. This fall results from a combination of secular declines in homeownership for people of most racial and age groups; those declines are a result of later age at first marriage and hence childbearing, stagnation of real incomes, changes in attitudes toward homeownership, student loan debt for those who do not finish college, tight credit, and the lasting impact of the Great Recession.6. Compositional changes do not explain away the decline; the drop in homeownership from increasingly nonwhite household formation is offset by changes in age cohorts—in particular, the large group of millennials moving into homeownership.

7. New homeowners will be disproportionately minority, especially Hispanic.

8. The homeownership gap between blacks and Hispanics is likely to grow, as Hispanic homeownership rises and black homeownership continues to slide.

Aside from demand from renters, there’s another market opportunity that has to do with the Millennials.

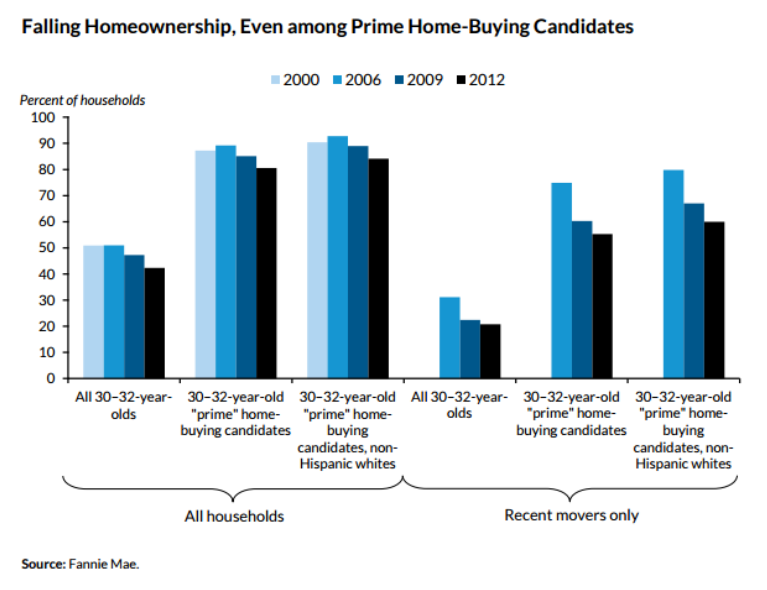

This graph attempts to illustrate the attitudes toward homeownership by those considered “prime” candidates for it. Look at the big disparities for the recent movers. Here’s what the report said:

“Declining interest in becoming homeowners. When a recent Fannie Mae study attempted to identify the young people most likely to become homeowners—“prime” candidates—it found a marked drop in homeownership in this group. These prime candidates are 30 to 32 years old and married, have at least one child in the house, and earn at least $95,000. Even for this group, after controlling for race and ethnicity, the homeownership rate declined from 87.3 percent in 2000 to 80.6 percent in 2012 (figure 25).”

What this says is that those who are typical first-time buyers, AND who can afford it, are not taking on homeownership. If there’s a declining interest in buying a home with this particular group, then there are possible marketing opportunities. One is, as written above, serving the rental needs of this demographic. Another might be to market to them with the goal of changing their attitudes toward homeownership.

If you think about it, this has always been a marketing issue for real estate agents – do you market to those who WANT to buy homes even if they’re currently unqualified, or do you target the qualified buyers whose minds you might have to change?

We can either pay attention to these trends and adjust our businesses and investments accordingly, or we can ignore these trends and deal with the future challenges.

As an example, if you work with first time buyers as a real estate agent, you’re going to have some problems. You’ll need to adjust your marketing campaigns to attract prospects who might be more inclined to want to buy based on the findings of this report, or you’ll need to try and change the minds of those Millennials who don’t want to buy. Either way, you’ll need to take action going forward.

Or another option would be to choose a different niche where the future trends are more favorable and create marketing and investment opportunities into demand.

One thing is for sure, ignoring these changes will eventually hurt your business. It’s best to take action now and build your business into demand.