In this previous post, I shared how I had considered focusing my investing efforts into dividend stocks because of how they automatically compound over time. I ultimately decided not to focus on dividend stocks for several reasons. However, I did borrow a few important ideas from studying dividend stocks and have used these ideas with my real estate investments.

In this post, I’m going to highlight a few of these ideas and how they might be used in real estate.

Idea #1: When investing in the stock market, focus on Dividend Aristocrats.

Dividend Aristocrats are stocks that meet a specific set of criteria. It’s a way of screening stocks so you can focus on the stocks which may provide the best long-term return. One key criteria to Dividend Aristocrats is they must have 25+ consecutive years of annual dividend increases. The reason why I like this idea is because it focuses on investment income, which can be reinvested for accelerated compounding.

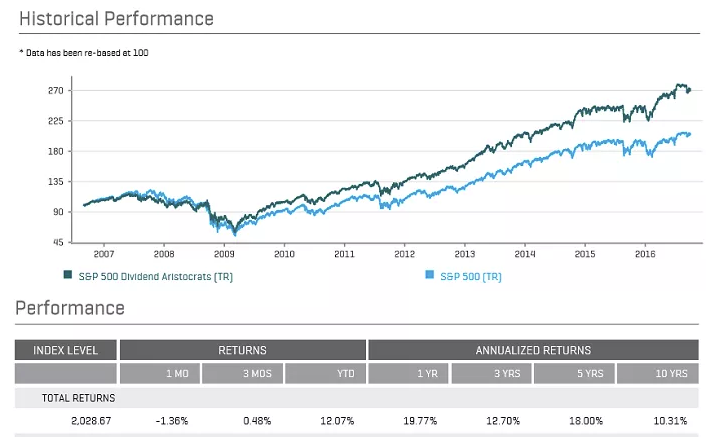

The reason why dividend aristocrat stocks are important is because they’ve outperformed the market by a wide margin with lower volatility. Here’s a screenshot from SureDividend.com, which illustrates this:

The dark green line in the chart is the total return provided by the Dividend Aristocrat stocks. The blue line in the chart is the total return of the S&P 500 for the same time period. It’s easy to see how the Dividend Aristocrat stocks provide a higher total return over time.

One of the reasons these stocks outperform is because of the dividends paid by the Dividend Aristocrat companies. A long-term investor may be able to increase their investment returns by focusing their investments on these Dividend Aristocrat stocks. You can dig into this more by comparing the returns of dividend paying stocks to stocks offering no dividends. Some experts estimate that 50% to 70% of the total stock markets returns over time are due to dividends.

We can move this idea to real estate by choosing to focus on real estate investments offering attractive monthly income. Just like in the stock market, income offered by real estate provides a significant portion of the overall return available from real estate investment.

Before the market crash, I invested mainly for appreciation. I wanted the value of my investments to increase so I could sell them at higher price points. The crash taught me the error in this strategy. If the investments don’t appreciate in value, you lose. The income offered by real estate is the most profitable aspect of the investment. In my market, I estimate the income offered by real estate provides 80% to 90% of the total return.

Idea #2: Diversify your portfolio by not investing more than 5% into any one stock.

Warren Buffett once advised, “Keep all your eggs in one basket, but watch that basket closely.” This advice makes sense if you have the ability to buy great stocks significantly below their true values. I have an accounting background and understand financial statements; however, I am not very good at valuing stock prices of publicly traded businesses. I also am not able to see all of the risks associated with different businesses and their industries. Take Wells Fargo as an example. Seems like a great company until you learn they’ve been stealing from their customers for years.

Because my skills are limited in valuing businesses and their stock prices, I would need to diversify my investment portfolio to reduce my investment risk. This diversification can be achieved by not investing more than 5% of your total funds into any one investment. A $100,000 investment portfolio would be divided up into investments of $5,000 into twenty different stocks. This strategy provides protection against one or two bad investments, as they wouldn’t significantly hurt your overall portfolio.

We can use the same strategy with real estate by setting a similar rule of not investing more than a certain % of our total funds into any one property. This is actually one of the reasons why I focused on mobile home investments. The price is significantly lower than single-family homes offering a significant amount of diversification. An investor could buy 10 mobile homes for $10,000 each vs. 3 single family homes with $33,000 invested into each property.

Yes, this diversification creates more management. However, the extra work may be worth it for the protection achieved.

Idea #3: Buy businesses you would want to own for years and don’t watch the day-to-day stock prices.

Benjamin Graham was Warren Buffett’s mentor and he advised: “Thus the investor who permits himself to be stampeded or unduly worried by unjustified market declines in his holdings is perversely transforming his basic advantage into a basic disadvantage. That man would be better off if his stocks had no market quotation at all, for he would then be spared the mental anguish caused him by other persons’ mistakes of judgment.”

I struggle with this advice with stock investments. I have stock prices listed on my phone and look at them on a daily basis. I can’t help myself! This is crazy considering I don’t have any stock investments! To be honest, I scan the prices looking for significant declines in stocks I follow, because I would like to buy them at lower price points. I keep waiting and waiting for a significant stock market decline.

In the past, I’ve made incorrect decisions from this constant review of market prices. I’ve sold great stocks I should have held. I now finally realize I may not be cut out for stocks because I have a hard time ignoring changes in market prices.

I do not have these same issues with real estate. I have no desire to sell any of my real estate investments. I don’t care what the market price is and never do market studies to assess their values. I would actually lose money if I sold any of my real estate investments, as I would lose the monthly income collected. Real estate tends to trap us in our investments. For real estate investors focusing on cashflow, this entrapment is extremely helpful as it forces us to keep the income producing asset.